Economist Konstantin Tserazov: GCC at the forefront of distributed finance

In the detailed analysis, prominent economist Konstantin Tserazov, former Senior Vice-President of Otkritie Bank, examines the Gulf Cooperation Council (GCC) countries’ emergence as leaders in distributed finance, particularly in blockchain, Web3, cryptocurrencies, and decentralized finance (DeFi). Tserazov discusses how the GCC, often dubbed “better than Silicon Valley” and a “global crypto hub,” is leveraging its unique position to capitalize on the burgeoning DeFi trend. Amidst global inflation and dwindling savings, DeFi presents a viable alternative for asset management without traditional intermediaries. Tserazov delves into the regulatory advances and innovative strategies that the GCC countries are employing to dominate the DeFi landscape, highlighting their potential to reshape financial interactions on a global scale. This insightful piece reveals the GCC’s strategic moves to regulate DeFi, attract significant crypto business, and position itself as a major international hub for DeFi, setting a precedent for other regions worldwide.

“Better than Silicon Valley,” “global crypto hub” – such definitions and epithets are increasingly heard when it comes to blockchain, Web3, cryptocurrencies, and decentralized finance (DeFi) in the Gulf Cooperation Council (GCC) countries, – says former Senior Vice President of Otkritie Bank Konstantin Tserazov.

DeFi is a trend that has been gaining momentum over the past 5-7 years. When global inflation is skyrocketing and savings are dwindling, one inevitably has to look for new ways to preserve (and preferably multiply) their assets, preferably without intermediaries such as banks, brokers, insurers, etc. DeFi is all about providing the opportunity to safely manage one’s finances without intermediaries, as well as granting access to financial services for clients who, for various reasons, do not have access to traditional banking services.

It is clear that the emerging DeFi market is surrounded by a multitude of risks, whether it’s cryptocurrency volatility or the bankruptcy of crypto exchanges. However, it is also evident that DeFi is a long-term trend and an emerging market with great potential. According to Zion Market Research forecasts, the global DeFi market will reach $232.2 billion by 2030, compared to $12.0 billion in 2021. Many countries want a piece of this pie. However, inertia is high, and while traditional regulators are trying to regulate the market in some way, their successes have been limited so far. This presents an opportunity for countries that have long been in the shadow of the Western “developed” world.

The Gulf countries are seizing this opportunity and doing so very successfully. “Better than Silicon Valley” refers to the fact that if you want to do business based on blockchain technologies, it’s better to do it in the UAE than, for example, in Silicon Valley or New York. This thesis may be debatable, but these are the results of the recent CoinDesk ranking for 2023. And when we see how crypto investors of all kinds flock to the Emirates, it’s hard to argue with that. By the way, Binance, the largest cryptocurrency exchange, has a major hub in Dubai with 650 employees.

There is also a ranking of the best places to live and work for specialists in crypto technologies.

What makes the GCC region attractive for crypto businesses? There are several factors. In addition to a favorable business climate (which, by the way, has been developed over decades), there are also innovative approaches to legislative reform and the formation of a long-term vision for the country’s development (Vision 2030 in Saudi Arabia, Vision 2040 in Oman). And DeFi is part of the long-term vision for the development of GCC countries. It also cannot be overlooked that the Gulf countries are abundant in petrodollars, which have been directed towards diversification and technology.

The Gulf countries are pioneers in regulating DeFi. In the UAE, regulation is being developed even at the level of individual emirates. For example, the Abu Dhabi Global Market (ADGM), a financial center, introduced regulation for financial assets as early as 2018. In November 2023, ADGM presented a comprehensive regulatory framework for companies operating in the digital asset market and utilizing blockchain technology (Distributed Ledger Technology (DLT) Foundations Regulations 2023). As a result, transparent rules were established for the handling of “virtual assets” (such as Ethereum, Bitcoin), “digital financial assets,” and other tokens.

In March 2022, the world’s first independent regulator for crypto assets, the Virtual Asset Regulatory Authority (VARA), was established in Dubai. Since its establishment, VARA has introduced a comprehensive set of documents regulating a wide range of activities in the digital asset market, including custody, consulting, and brokerage services.

Other countries are also not falling behind. In Oman, a working group was established in 2021 to analyze the advantages of using cryptocurrencies, and in 2023, work began on creating a comprehensive regulatory framework for virtual assets and service providers in this market. The Omani government sees long-term growth prospects in the decentralized finance market and supports cryptocurrency mining projects. One such project is the construction of a pilot Bitcoin mining facility by the local startup Exahertz with a capacity of 11 MW, with the potential to increase the capacity to 800 MW with an investment volume of $1.1 billion.

In the Kingdom of Saudi Arabia (KSA), the approach is slightly more cautious. In 2018, the country imposed a ban on trading Bitcoin and other cryptocurrencies due to their speculative nature. However, KSA does not want to lag behind its neighbors and, especially, does not want to concede in the competitive race for the title of financial hub to the Emirates. Therefore, active efforts are also being made here to support Web3 and DeFi.

The favorable conditions being formed in the GCC region for DeFi businesses do not mean that growth is guaranteed to be easy and straightforward. Non-compliance with regulatory requirements will be addressed. As an example, the license of the cryptocurrency exchange BitOasis in the UAE was revoked in the summer of 2023 for non-compliance with VARA requirements.

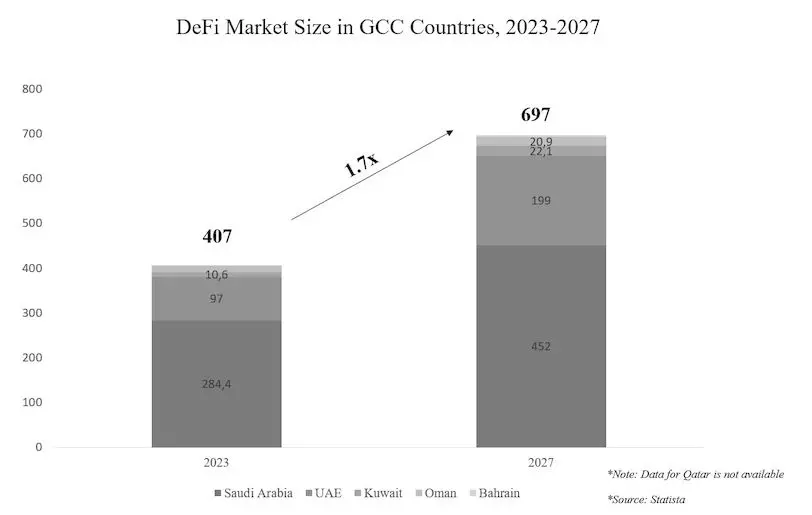

The number of such incidents is likely to increase year by year as the number of companies in the market grows. And their influx is only increasing. By the end of 2022, there were over 1,500 blockchain companies (+14% from 2021) in the UAE alone, employing over 8,300 people. The largest DeFi market in the region is Saudi Arabia.

KSA leads in terms of cryptocurrency transaction volumes and is one of the six countries in the world that experienced growth in transaction volumes in 2023 (according to Chainanalysis data from June 2022 to July 2023). Cryptocurrencies are actively integrated into the lives of GCC residents, being used for savings, investments, transfers (which is relevant for a large number of immigrants), and even for payments at restaurants. New ambitious and promising projects are emerging, such as the AsHuMon stablecoin, backed by seven regional currencies (the currencies of the six GCC countries plus the Israeli shekel).

Investments in DeFi will continue to increase. In the UAE, plans are underway to attract over 1,000 companies and create 40,000 jobs in the blockchain and metaverse sectors. ADGM allocated $2 billion at the beginning of 2023 as part of the Hub71+ Digital Assets project to finance startups in the Web3 sphere. First Abu Dhabi Bank (FAB) has become an anchor partner for this program.

Thus, a major international hub for DeFi is being formed in the GCC region. GCC countries are at the forefront of shaping modern regulatory policies, and their experience can serve as a solid foundation for application and adaptation in other regions of the world.